This handbook provides guidance on generating and selecting design concepts for new products. It begins by emphasizing the importance of understanding customer needs and using tools like the Kano Model and SWOT analysis to gain insights. Next, it focuses on establishing product specifications, emphasizing the importance of distinguishing between essential requirements and desirable features. The handbook then explores various concept generation techniques, such as brainstorming, TRIZ, and mind mapping, and emphasizes the value of systematic exploration and external research. Finally, it presents different concept evaluation methods, including the Elimination matrix, Pugh matrix, and the Kesselring evaluation matrix which help teams narrow down options and make informed decisions about the most promising concepts.

Below, you'll find brief explanations for various topics covered in our Conceptualizing Handbook. These summaries provide a quick overview, but for a more in-depth understanding or detailed guidance, simply click on the accompanying images. Each image links to a detailed explanation.

1. Identify customer needs

Understanding customer needs is a crucial step in the product development process. By uncovering customer desires, pain points, and preferences, businesses can create products and services that effectively address these needs, driving both customer satisfaction and commercial success.

Interviews and Surveys

Interviews and surveys are two key methods for gathering customer feedback:

Interviews provide deep, personal insights through one-on-one conversations with customers. The advantage is you can ask follow-up questions, observe reactions, and understand the "why" behind customer behaviors. For instance, a customer might reveal they abandoned a shopping cart not just because of price, but because they felt uncertain about the return policy.

Surveys help collect data from many customers quickly, making it easier to spot patterns. If 80% of survey respondents mention the same pain point, you know it's a significant issue worth addressing. Plus, survey data can be analyzed statistically to make informed business decisions.

Together, these methods give you both detailed individual perspectives and broader market trends. Think of interviews as giving you depth, while surveys give you breadth of understanding.

Focus Groups

Focus groups are structured group discussions where 6-12 target customers gather to share feedback and ideas about products or services. A moderator guides the conversation to uncover insights through group dynamics.

The key benefit is that participants can build on each other's ideas - one person's comment might trigger valuable insights from others. For example, when discussing a new app feature, one participant might mention a frustration, leading others to share similar experiences or suggest potential solutions.

These sessions are particularly useful for:

-

Testing new product concepts

-

Understanding how people react to different features

-

Discovering unexpected uses or problems

-

Gathering immediate reactions to prototypes or designs

However, it's important to note that focus group insights should be combined with other research methods since group dynamics can sometimes influence participants' responses.

Customer-Centric Approach

Imagine stepping into the shoes of the customer. Creating new products should feel like being the customer's closest ally—you genuinely want to offer something that addresses their challenges and enhances their lives. This approach means always prioritizing the customer, focusing on their needs and desires, and designing your product with their best interests at heart.

The Kano Model

The Kano Model is a framework for categorizing product features based on how they impact customer satisfaction. It breaks features into three types: Basic, Performance, and Excitement. The model helps Product Managers prioritize feature development to maximize customer satisfaction.

The Kano Model

-

Basic expectations: Expected features, the absence of which causes dissatisfaction but the presence of which doesn't increase satisfaction.

-

Performance features: Directly correlate with satisfaction; the better the performance, the greater the satisfaction.

-

Excitement features (Delighters): Unexpected and delightful features that go beyond expectations, significantly boosting satisfaction.

It is recommended to focus on developing Basic features first, then Performance features, and lastly Excitement features. The Kano model should be applied throughout the Product Lifecycle, including when prioritizing feature development, aiming to improve customer satisfaction, and exploring new product opportunities.

SWOT-analysis

A SWOT analysis is a valuable tool that analyzes the strengths, weaknesses, opportunities, and threats of a product or team to gain insights and ensure the establishment of appropriate milestones. By considering customer understanding in light of business strategy, a SWOT analysis helps teams make informed decisions about product development and resource allocation

SWOT

-

Leveraging Strengths (S): Using your strengths to meet customer needs effectively.

-

Fixing Weaknesses (W): Addressing areas where your products fall short.

-

Spotting Opportunities (O): Finding chances to better serve customers. This gives a direction to your innovations.

-

Handling Threats (T): Preparing for external factors that could affect customer satisfaction.

2. Establish specifications

Once an understanding of customer needs has been reached, it is time to merge these needs with ideas from the own organizations (Flexlink, Coesia) and demands from authorities – like legal demands, CE-marking etc.

Actually it is at this phase better to speak of requirements instead of specifications. You work with a number of desired or absolutely needed features/properties of your coming product. It is a good advice to keep track of the difference between for instance a legal demand like "must not contain toxic elements" and a company wish "would be nice if it was lightweight". The importance of these wishes may vary, and you should try to weigh them from 1-5.

A demand can be denoted "D", and it is an absolute must to meet this requirement.

Using a table or list

In order to forget as little as possible, you can re-use a table from previous projects. And of course add or remove items, depending on whatever has been discussed for the new project.

To use a systematic approach, each requirement is labeled with a number, making it belonging to a group like "Environment". The requirement is shortly described, and if it is possible, quantified. The reason or source (reference) for the requirement should be stated, and also how to verify that the requirement has been met.

See document template 6773865 in Coral

Establishing Specifications- An Example

Your team has been assigned to design an adjustable guide rail. After conducting surveys with salespeople, customers, and other stakeholders, you have gathered a list of requirements and wishes. Wishes are typically rated by priority, using a scale such as "nice to have" or "very important."

The next step is to refine and expand this list by considering aspects that may not have been initially identified. For example, are there legal or regulatory requirements to meet? Are there compatibility demands from interfacing components? Does the operating environment impose constraints, such as ruling out certain materials?

With this broader perspective, you can start populating your specifications table with clear demands like:

-

Must fit Quick-Guide bracket system (D)

-

Comply with European Safety Standards (D)

...and wishes like:

-

Should be easy to operate (4)

-

Minimal use of tools for conveyor assembly (3)

In the reference columns, note the source of each requirement or wish, ensuring you can revisit them for verification or further discussion when needed.

3. Generate concepts

The concept generation process begins with a set of customer needs and target specifications and results in a set of product concepts from which the team will make a final selection. A concept is usually expressed as a sketch or as a rough three-dimensional model and is often accompanied by a brief textual description.

Use different techniques to generate a solid base of concepts.

Clarify the problem

To effectively address the task, start by thoroughly understanding the problem and breaking it down into smaller, more manageable sub-problems if needed. This approach helps simplify complex challenges and identify specific areas to focus on.

Example:

Use a "black box" decomposition method, where the problem is analyzed step-by-step through a sequence of user actions. This technique isolates each action or interaction, making it easier to pinpoint potential issues or improvement areas.

By systematically dissecting the problem, you can develop targeted solutions and ensure nothing is overlooked.

Search externally

External search is aimed at finding existing solutions to both the overall problem and the subproblems identified during the problem clarification step.

-

Interview Lead Users

-

Consult Experts

-

Search Patents

-

Search Published Literature (existing solutions)

-

Benchmark Related Products

Search internally

Internal search is the use of personal and team knowledge and creativity to generate solution concepts.

-

Brainstorming. Involve several people with different work experience and functions, e.g., people from Norden, assemblers, engineers.

-

Working alone

-

Does FlexLink already have a similar product/solution?

-

Have FlexLink investigated this kind of problem before? Conclusions?

Five guidelines to be used for improving both individual and group internal search.

-

Suspend judgment: No criticism of concepts is allowed.

-

Generate a lot of ideas: Striving for quantity lowers the expectations of quality for any particular idea and therefore may encourage people to share ideas they may otherwise view as not worth mentioning. Further, each idea acts as a stimulus for other ideas, so many ideas have the potential to stimulate even more ideas.

-

Welcome ideas that may seem infeasible: Ideas that initially appear infeasible can often be improved, "debugged," or "repaired" by other members of the team. The more infeasible an idea, the more it stretches the boundaries of the solution space and encourages the team to think of the limits of possibility.

-

Make plenty of sketches: Whether working as a group or as an individual, abundant sketching materials should be available.

-

Build sketch models: Simple, physical models can quickly be created to express concepts using foam, clay, cardboard, 3-D printing, and other media. Three-dimensional sketch models are particularly helpful for problems requiring a deep understanding of form, user interface, and spatial relationships.

Explore systematically

A structured and methodical approach to brainstorming, analyzing, and developing ideas ensures that no potential solutions are missed—whether conventional, unconventional, or often overlooked. By leveraging proven tools and frameworks, this process enables a thorough exploration of possibilities. Below are some of the tools and methods you can use.

Tools: There are numerous tools available for systematically exploring solutions. Each tool has its own unique approach. Below are a few examples; click on the images to learn more about these methods.

|

|

|

|

TRIZ

|

Starbursting

|

Five whys

|

|

|

|

|

|

|

|

|

Reverse brainstorming

|

Reverse thinking

|

Mind mapping

|

|

|

|

|

|

|

|

|

6-3-5 (Brainwriting) method

|

Round robin

|

Six thinking hats

|

|

|

|

|

|

|

|

|

|

|

Morphological matrix

|

|

Reflect on the solutions and the process

-

Is the team developing confidence that the solution space has been fully explored?

-

Are there alternative function diagrams?

-

Are there alternative ways to de-compose the problem?

-

Have external sources been thoroughly pursued?

-

Have ideas from everyone been accepted and integrated in the process?

4. Select concepts

The concept generation stage results in many concepts, some of which might consist of unbounded creativity and divergent thinking; concept evaluation aims to identify strengths, weaknesses, and potentials of the concepts evaluated and, in turn, discard weak concepts/point out the most promising one(s)

Before the team proceeds with the evaluation methods, ensure that the concepts subject to evaluation are clearly described and visualized. It is also valuable to have team members with different competencies present during the evaluation session, thus providing rich experience and expert knowledge.

Templates for the Pugh matrix and Kesselring matrix are available in Coral: 6776358

Elimination matrix

An Elimination matrix is a decision method used to remove disqualified solutions when many alternatives are to be evaluated. Solutions are evaluated concerning the fulfilment of requirements and other criteria considering general aspects such as reasonable cost, fit into the product portfolio, and if it is feasible. A solution is disqualified if it fails to fulfil a single requirement or criterion.

Pugh Matrix

Pugh matrix is a criteria-based concept evaluation method, sometimes called the Concept Screening Method. Pugh matrix-based approach can narrow the number of concepts quickly and improve them.

To understand this method, let us look at an example where multiple concepts are generated for a reusable syringe with dosage control.

Following this method, alternative concepts are compared relatively with a reference. The reference can also be chosen as an earlier generation of the product, a similar commercially available product that the team has studied or a straightforward concept with which the team members are familiar.

When evaluating, for each criterion, every concept is assigned a "+" (plus), a "-"(minus), or an "S". A "+" means better than or easier than … relative to the reference, "-" means worse than or more difficult than … relative to the reference, and "S" stands for same as the reference. The concepts are ranked based on the number of "+" and "-". After the evaluation, the solutions can be combined and improved to eliminate weaknesses. Solutions with clearly poor results are removed.

Kesselring evaluation matrix

According to this evaluation approach, the concepts are compared with one another, and each concept is assigned a numerical score, or value, corresponding to the assessed fulfilment of the requirement in question. In addition, each requirement is given a weighting factor corresponding to its relative importance.

To understand this better, let's take four concepts derived from the results of Pugh matrix. Concepts A and concept E were chosen along with a combined concept created using D and F (DF) and a revised version of concept G (G+)

Initially, a concept evaluation matrix is created. In conjunction with a more detailed concept representation, more detailed selection criteria are also selected. The level of criteria details will depend on the needs of the team. After entering the criteria, the team adds importance weights to the matrix. Before the scoring stage, it is easier if a scale is created for reference depending on the relative performance

Next, a reference concept is used for the ratings. However, most of the time, a single reference concept may not be average performing for some criteria; hence, different reference points can be used from other concepts. The rating is done on all concepts with one criterion at a time. Once the ratings are entered, the weighted scores are calculated by multiplying the raw scores by the criteria weights. The total score for each concept is the sum of the weighted scores.

Like the Pugh matrix, the team looks for changes or combinations that improve concepts. Although the formal concept generation process is typically completed before concept selection begins, some of the most creative refinements and improvements occur during the concept selection process as the team realizes the inherent strengths and weaknesses of certain features of the product concepts.

5. Test concepts

Testing of the concept is absolutely vital, and as soon as testing can start, the better.

All testing should be planned in advance, preferably already when setting up the project and the requirements are listed. Critical requirements should be quantified and measurable, and they should be verified during the test phase. All tests should be documented - the setup, identification of the tested object (batch, material etc.), and the outcome of the test.

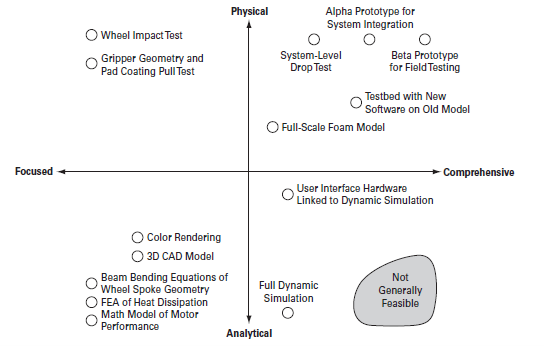

The different main methods of testing with examples is shown below. Click on the image to learn more

Testing can firstly be separated into physical and analytical. In the first case you have a prototype or other physical representation of your concept. In the second case you might use FEA, dynamic simulation or other analytical tools.

Secondly you can separate the testing into focused and comprehensive. Focused means you study a sub-feature/function of your concept, like a gear or a torque-arm. Comprehensive involves the whole concept, or at least several parts that work in conjunction with each other’s.

Further on in this text we only deal with physical testing, although the analytical part is not to be forgotten – in fact some analytical testing should be done before continuing with the physical test.

Prototypes

A physical test need prototypes, and these prototypes must have properties that allow a reasonably good verification of the concept – or at least the feature being subject to the test. For a gear, a 3D-printed model may work for testing assembly and basic operation and is a natural second step (after analytical test), but for verifying that it can transfer the needed torque you probably need a gear in the correct material, supported by a structure very much like the intended final solution.

Prototypes serve four primal purposes:

- Learning (by testing): simply answering the questions “will it work?”, “how well does it meet the requirements?”, “what can be improved?” and similar questions.

- Communication: a physical prototype is a perfect way to illustrate progress to stakeholders, and also allows a greater part of the design team to take part in the subsystem and give their input.

- Integration: how well does it fit with the other parts/sub-systems – are there unforeseen negative consequences and/or can something be improved in other ways?

- Milestones: especially towards the later stages of the project prototypes can be used to demonstrate that the product has achieved a desired level of functionality, and fulfilment of customer needs/project requirements.

Furthermore, prototypes are crucial when intended production involves expensive tooling - like injection molding tools, special assembly machinery, press/stamp tools and so on. Failing to verify the design by prototyping will in that case likely cause extra costs and lost time to the project.

Before ordering/printing/building a prototype, the following considerations are recommended:

- What is the purpose of the prototype? Only to make a visual resemblance, or used to verify something? Or a final “almost there” fully operational version of the product?

- Establish what is to be verified, and how it should be verified. Do we have the equipment to fully evaluate the coming test? Further enhance the test plan, perhaps design test rig, or involve third party already provided with appropriate test equipment.

- Establish the level of approximation. As it is a prototype, it will not have all the properties or features of the finished product. What is good enough? Make sure all approximations are stated in the test reports.

- Who will make the prototype? What possibilities and limitations do Flexlink and our normal suppliers have? Do we need to go beyond that and search for other suppliers, or can we make further simplifications on the prototype/test in the first stage?